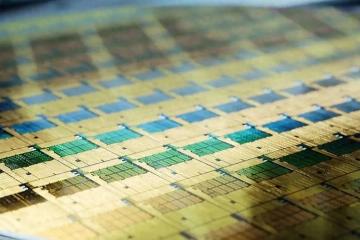

The Foundry's Focus on Silicon Photonic Chips

Advertisements

In a remarkable development, Tower Semiconductor, a prominent player in the semiconductor industry, is set to witness a substantial growth trajectory in its silicon photonics revenueThe company anticipates doubling its earnings this year, reaching an impressive figure of approximately $100 million.

Marco Racanelli, the President of Tower Semiconductor, shared insights with EE Times, indicating that the company has effectively tapped into the burgeoning demand for chips that support artificial intelligence (AI). Analysts have pointed out that this Israeli chip foundry is ahead of its competitors in the production of silicon photonics and silicon germanium, which are crucial for enhancing data transfer rates and reducing power consumption.

This innovative technology has granted Tower a distinct competitive advantage over larger rivals such as TSMC and Intel, both of which have also entered the photonics sector

Racanelli elaborated on the massive potential of silicon photonics in the context of AI applications, stating, "We see tremendous demand for both silicon photonics and silicon germanium." The company is utilizing silicon germanium to manufacture amplifiers, transimpedance amplifiers, and drivers for these modules while producing all optical components within their silicon photonics capabilities.

Furthermore, Tower Semiconductor is bolstering its product line by collaborating with OpenLight, a partner specializing in laser technologyThis partnership aims to create a robust ecosystem for manufacturing silicon photonic chipsRacanelli noted, "In the next generation, at some point, we see the opportunity to integrate lasers using OpenLight’s processes."

As the company sets its sights on the future, they project that silicon photonic revenue will not only double this year but may potentially double again in the following year

- Common Psychological Pitfalls for Investors.

- The Dilemma of Automotive LiDAR

- Bitcoin in 2024: Global Regulation Takes Shape

- Tongcheng Targets International Expansion After $8B Valuation

- Who Will Power the AI Boom?

Racanelli mentioned that this burgeoning sector could account for around 10% of Tower's total revenue within one or two years, indicating a strong upward trend.

Research analyst Richard Shannon from Craig-Hallum highlighted that Tower Semiconductor currently boasts over 50 clients within the silicon photonics space, with seven of them being among the top 11 manufacturers of data communication transceiversThis client base underscores the growth and prominence of Tower in this competitive market.

Shannon’s report conveyed optimism about silicon photonics, emphasizing that it could lead to lower-cost and lower-power transceivers

He anticipates significant advancements in this technology, particularly as the industry transitions to 800G and 1.6T systems, thus enhancing data handling capabilities immensely.

The evolving landscape of data communication is reflected in the latest 800G transceivers, which are capable of transferring vast amounts of dataMost of the optical components employed in modern data centers now utilize standardized pluggable connectors, facilitating seamless integration with switching and graphics processing units (GPUs). This shift is moving toward silicon-based co-packaged optical devices, thus bringing the conversion interface closer to computational units.

Shannon articulated Tower's edge in the pluggable products market, claiming it holds dominance due to its highly customizable processes that cater to individual client needs—a distinction from competitors

In addition, Tower has plans to release a version that integrates lasers into hybrid products, which is expected to debut shortly.

Racanelli noted that the surge in demand for optical transceivers is largely driven by AI, stating, "Anyone who uses fiber for AI, data center interconnects, or networking will be a buyer of optical transceiversThis enormous growth is attributed to AIAlthough it’s somewhat challenging to break through, overall, we believe most of the growth stems from AI integration."

Moreover, Shannon elaborated that all data communication optical transceivers require transimpedance amplifiers and drivers, wherein Tower excels with a market share exceeding 50%, serving leading companies such as Macom Technology and Semtech Corp

He stated, "If linear pluggable optical devices (LPO) succeed, the value of TIA and drivers will rise, presenting even greater growth potentialTower is the main foundry for ACC."

In 2022, after China’s market regulators blocked Intel’s acquisition of Tower, this smaller foundry secured capacity at Intel's factory in New Mexico with a $300 million investmentPreviously, in 2021, Tower made a similar investment in STMicroelectronics’ fab in Agrate, Italy.

The collaboration with Intel is expected to enhance Tower's production of power management integrated circuits (ICs). Racanelli mentioned, "This presents a significant capacity increase for us and our customers on 300-millimeter wafers

We are transitioning one of our power management processes to this site, which is our most advanced power management process; currently, it operates solely in our facility in Japan, and one smaller 300-millimeter facility is still producing."

Racanelli commented on the advantageous nature of this arrangement, stating, "We scored a deal here; we didn’t have to build a new fabWe are just taking a portion of their existing plant to implement our current power management processWe expect to start production in 2025, so we’ll begin to see some benefits as soon as next year."

Tower Semiconductor has emerged as one of Intel's new customers, further solidifying its place in the semiconductor ecosystem.

Racanelli elaborated on this partnership, stating, "We are Intel's foundry customer, but we are employing our own technologies

We've set up our tools in one of Intel's factories, effectively renting part of their plantThe employees there are Intel's, and it’s just a segment of the larger factory, but this setup is incredibly efficientIn this expansive facility, many resources, including operators and infrastructure, are sharedThis drastically reduces operating costs, as we are leveraging resources from the entire fab, despite only occupying a fraction of it."

Tower’s cutting-edge processing technology operates on mature process nodes, ranging from 45 nanometers down to less than a quarter-micronWith wafer fabrication facilities located in Israel, the United States, and Japan, Tower Semiconductor is strategically positioned within the semiconductor landscape to exploit growing opportunities.

Leave a Reply