Semiconductor Testing: A Crowded Field

Advertisements

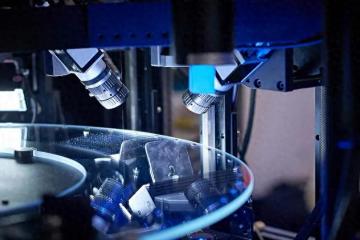

In a rapidly evolving world of technology, the semiconductor industry stands at the forefront, embodying not just innovation in chip design and manufacturing, but also the significant shift toward specialized testing servicesThe case of Sengke Nano, a proactive player in this domain, sheds light on the rising importance of third-party testing for semiconductors, emphasizing the unique benefits it brings to the entire semiconductor supply chain.

Founded in 2012, Sengke Nano specializes in semiconductor analysis, providing clients with vital services like failure analysis, material analysis, and reliability assessmentsIts successful attempt to land an initial public offering (IPO) acceptance by the Science and Technology Innovation Board in May 2023 not only emphasizes the company’s credibility but also reflects a growing demand for semiconductor testing services in an increasingly competitive market.

Historically, the semiconductor industry operated under an Integrated Device Manufacturer (IDM) model, effectively consolidating design, manufacturing, and testing processes within a single organization

Although this model offered comprehensive control, it also posed significant limitations — particularly in adapting swiftly to technological changes and market demands in today’s fast-paced environmentRising R&D costs and the challenge of maintaining diverse product lines have necessitated a shift away from traditional practices.

The evolution toward a Fabless-Foundry-OSAT (Outsourced Semiconductor Assembly and Test) model represents this major transitionThis division of labor in semiconductor production allows companies to focus on their core competencies while outsourcing other aspects to specialistsFabless companies, for instance, design chips without engaging directly in manufacturing; they rely on foundries for production and OSAT firms for assembly and testingThis collaboration provides enhanced R&D efficiency and a more robust response to evolving industry demands, which has become vital in minimizing investment risks.

Within this landscape, third-party testing has emerged as an independent and essential facet of this intricate ecosystem, driven by the necessity for specialization and neutrality

- Common Psychological Pitfalls for Investors.

- The Dilemma of Automotive LiDAR

- Bitcoin in 2024: Global Regulation Takes Shape

- Tongcheng Targets International Expansion After $8B Valuation

- Who Will Power the AI Boom?

Companies across the semiconductor production chain are increasingly turning to independent testing laboratories to fulfill crucial analysis needs that span the entire production cycleThe establishment of dedicated testing firms has surged since the late 1980s, with companies like Jingyuan Electronics pioneering third-party testing, distinguishing themselves from conventional integrated testing and packaging manufacturers.

The significance of third-party testing is not merely reputational; it serves practical needs across the supply process, addressing areas such as failure analysis which requires a nuanced understanding of various disciplines including electronics, materials science, and physical chemistryIndependent laboratories have become catalysts in hunting for solutions that expedite development times and enhance production processesAs demand for rigorous testing grows, companies such as Yike and Hongkang have burgeoned alongside the local semiconductor industry, developing faster and more sophisticated analytical services.

The need for specialized testing is underscored by the emergence of trends like the Labless model, which champions outsourcing laboratory functions to independent specialists

This model encompasses a light laboratory approach, where companies maintain a small in-house lab to handle urgent or highly confidential analysis while outsourcing the majority of testing needs to third partiesBy adopting a Labless strategy, companies can effectively bypass the high costs of maintaining equipment and the risks associated with fluctuating analysis demands, thus nurturing focus on enhancing their core business operations.

This transformation also brings significant economic advantagesThe heavy financial burden tied to advanced testing equipment—frequently valued in millions—has proven too steep for most firms to bear sustainablyBy outsourcing to third-party laboratories that are equipped with cutting-edge technology, semiconductor companies can significantly reduce operational costs while retaining access to top-tier analysis without the inherent overheads.

Equally, when it comes to expertise, third-party testing labs are staffed with professionals possessing diverse knowledge and specialized skills, enabling them to tackle complex problems across the semiconductor lifecycle effectively

Unlike in-house labs that often consist of personnel focused narrowly on specific manufacturing processes, independent laboratories draw from a broader talent pool, thus fostering innovation and precise problem resolution.

Neutrality is another crucial feature of third-party testingIn an industry where failures might stem from myriad stages in the supply chain—from chip design to material issues—having an unbiased partner is essentialIndependent labs provide impartial analyses, helping companies trace the origins of defects accurately and propose actionable improvements for designs and processesIn this sense, they serve as trusted advisors in a domain that increasingly requires accountability and quality assurance from its players.

Despite the promising landscape for third-party semiconductor testing, the field is becoming increasingly crowded and competitiveData indicates that the global market for semiconductor third-party testing has recently surpassed $3 billion, with forecasts suggesting it could reach $7.5 billion by 2028 as demand continues to outpace growth in other sectors

In China alone, projections show the third-party testing market could exceed 10 billion Yuan by 2024 and further balloon to between 18 to 20 billion Yuan by 2027, reflecting a compound annual growth rate exceeding 10%.

Nevertheless, this burgeoning opportunity comes with challengesCurrently, the number of independent third-party testing firms in mainland China numbers in the dozens, resulting in intense competitionMany of these businesses are concentrated in revenue brackets between 100 million to 300 million Yuan, overshadowed by larger players in other semiconductor sectors that boast annual revenues measured in the billionsMoreover, the path to scaling and innovating in this environment heavily relies on the procurement of sophisticated equipment, which can add to the financial strain.

In summary, as we witness the evolution of technology and the growing complexity within the semiconductor supply chain, the role of third-party testing is undeniable

Leave a Reply